Tax Rate Bc Vs Ontario . Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. Use this calculator to find out the amount of tax that applies to sales in canada. Enter the amount charged for a purchase before. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75. Choose your province or territory below to see the combined federal &. Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base.

from www.fortbendisd.com

Use this calculator to find out the amount of tax that applies to sales in canada. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75. Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. Enter the amount charged for a purchase before. Choose your province or territory below to see the combined federal &. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and.

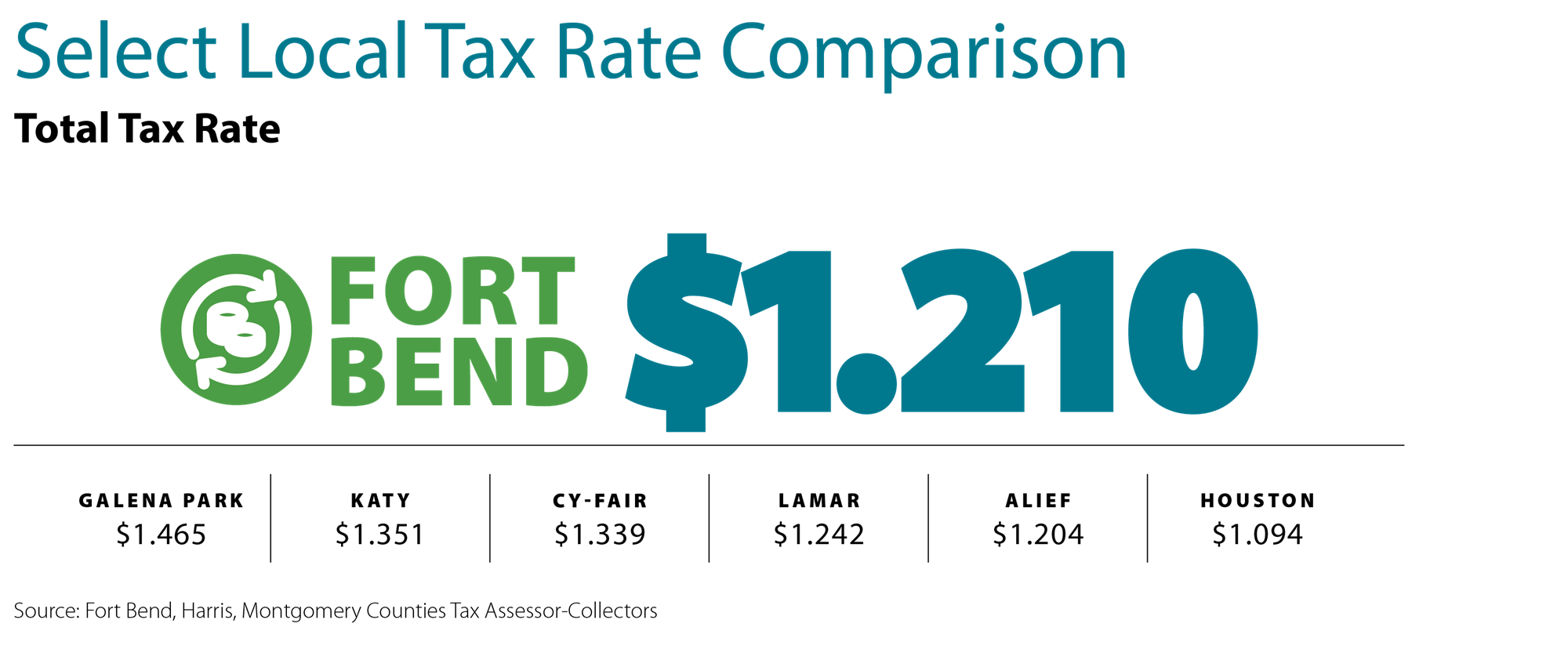

VATRE / Tax Impact

Tax Rate Bc Vs Ontario The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Use this calculator to find out the amount of tax that applies to sales in canada. Choose your province or territory below to see the combined federal &. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Enter the amount charged for a purchase before.

From www.avalonaccounting.ca

Corporate Tax Rates Canada 2022 Blog Avalon Accounting Tax Rate Bc Vs Ontario This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75. Enter the amount charged for a purchase before. Use this calculator to find out the amount of. Tax Rate Bc Vs Ontario.

From cardinalpointwealth.com

Winter 2021 Canadian Tax Highlights Cardinal Point Wealth Tax Rate Bc Vs Ontario Enter the amount charged for a purchase before. Use this calculator to find out the amount of tax that applies to sales in canada. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Choose your province or territory below to see the combined federal &. Information on income. Tax Rate Bc Vs Ontario.

From www.fraserinstitute.org

Tax Rate Bc Vs Ontario Enter the amount charged for a purchase before. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. Choose your province or territory below to see the combined federal &. Some. Tax Rate Bc Vs Ontario.

From www.navaelmilawyer.com

Nava Elmi Enterpreneurs Articles Ontario Enterpreneur Tax Rate Bc Vs Ontario This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged. Tax Rate Bc Vs Ontario.

From www.pinterest.ca

Calculate HST & GST for all provinces in Canada. Federal and provincial Tax Rate Bc Vs Ontario Choose your province or territory below to see the combined federal &. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Enter the amount charged for a purchase before. Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base.. Tax Rate Bc Vs Ontario.

From fbc.ca

2022 Canadian Corporate Tax Rates and Deadlines FBC Tax Rate Bc Vs Ontario The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75. Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base.. Tax Rate Bc Vs Ontario.

From elchoroukhost.net

Payroll Tax Tables 2018 Ontario Elcho Table Tax Rate Bc Vs Ontario Enter the amount charged for a purchase before. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Information on income tax rates in canada including federal. Tax Rate Bc Vs Ontario.

From www.templateroller.com

Form T2203 2019 Fill Out, Sign Online and Download Fillable PDF Tax Rate Bc Vs Ontario Use this calculator to find out the amount of tax that applies to sales in canada. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. Choose your province or territory. Tax Rate Bc Vs Ontario.

From www.canadianmoneysaver.ca

Understanding The RRSP Withdrawal Withholding Tax Canadian MoneySaver Tax Rate Bc Vs Ontario Enter the amount charged for a purchase before. Choose your province or territory below to see the combined federal &. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369. Tax Rate Bc Vs Ontario.

From www.crowe.com

Canadian Sales Tax Registration Requirements Crowe Soberman LLP Tax Rate Bc Vs Ontario This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Enter the amount charged for a purchase before. Use this calculator to find out the amount of tax that applies to sales in canada. Some provinces combine the federal goods and services tax (gst) and provincial sales tax. Tax Rate Bc Vs Ontario.

From www.youtube.com

BC VS. ONTARIO Best Province to Live in Canada? Pros & Cons of Tax Rate Bc Vs Ontario Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Use this calculator to find out the amount of tax that applies to sales in canada. Information on income tax. Tax Rate Bc Vs Ontario.

From www.incometaxottawa.ca

Federal and Ontario Average Tax Rate 2013 Solid Tax Professional Tax Rate Bc Vs Ontario Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. Enter the amount charged for a purchase before. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Use this calculator to find out the amount of tax that applies. Tax Rate Bc Vs Ontario.

From alexirish.com

Who Pays the Least Property Tax in Ontario? The Answer may Surprise You Tax Rate Bc Vs Ontario Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. Choose your province or territory below to see the combined federal &. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Enter the amount charged for a purchase before.. Tax Rate Bc Vs Ontario.

From www.fraserinstitute.org

Tax Rate Bc Vs Ontario Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. Enter the amount charged for a purchase before. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75. Use this calculator to find out the amount of tax that applies to. Tax Rate Bc Vs Ontario.

From tentho.com

LLC Tax Rate Tentho Tax Rate Bc Vs Ontario Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Amongst the western provinces and ontario, the marginal provincial rate at the national average income level ranged from 7.70 to 12.75.. Tax Rate Bc Vs Ontario.

From www.youtube.com

Taxes in B.C vs Ontario shorts tax canadataxes YouTube Tax Rate Bc Vs Ontario Use this calculator to find out the amount of tax that applies to sales in canada. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. Enter the amount charged for a purchase before. Some provinces combine the federal goods and services tax (gst) and provincial sales tax (pst), while others base.. Tax Rate Bc Vs Ontario.

From www.wrapbook.com

What are Payroll Taxes? An Employer's Guide Wrapbook Tax Rate Bc Vs Ontario This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and. Enter the amount charged for a purchase before. The provincial tax burden for an individual at the average income level in british columbia is $2,353, $2,369 in ontario, and. Amongst the western provinces and ontario, the marginal provincial. Tax Rate Bc Vs Ontario.

From fcpp.org

2019ProvincialTaxRates Frontier Centre For Public Policy Tax Rate Bc Vs Ontario Choose your province or territory below to see the combined federal &. Enter the amount charged for a purchase before. Information on income tax rates in canada including federal rates and those rates specific to provinces and territories. This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and.. Tax Rate Bc Vs Ontario.